Fintech is changing the financial landscape and the way traditional financial institutions (FIs) work. As a result, it appears people are implementing this portmanteau of financial technology over traditional banking channels, while implementing DevOps and agile practices, and MiFID 11 guidelines.

According to the Automation Test Lead at HSBC Private Banking, Richard Owusu, technology has revolutionised and brought up new ways of banking which didn’t exist before.

New ways of banking ushered in by technology:

- Cryptocurrency

- Open banking: allows third-party institutions to create their own applications to interact with banks

- Robo-advisors: algorithms that work out some of the complex decision making in banking.

Advantages fintech brings over traditional banking:

- Makes banking products highly available to customers 24/7

- Online Bank is far easier and cheaper to setup than the traditional mortar and brick banks

- Customers can conveniently make a transaction at any place and time

- As banking becomes very complex, technology is relied upon to reduce human errors and oversight.

“Technology and finance have become inseparable in the last decades, it is far easier, cheaper and convenient to set up an online bank than building a brick and mortar bank for a financial institution,” added Owusu.

Cutting-edge tech

Differently, adopting DevOps practices has become key for many fintech firms wanting to deliver a steady stream of banking applications. By implementing a DevOps culture, application delivery time can be reduced, and product quality can be improved. As long as DevOps is built into the application lifecycle, methods can be emphasised for collaboration between testing teams, and development and deployment tools can be used for scalability, predictability, manageability, high availability and support.

Joshua Grant, Automation Engineer at SpotX, agreed: “From a testing point of view, my two cents would be that, due to younger and smaller organisations, fintech has afforded a great lever of flexibility and ease in taking contemporary methods and patterns of working onboard, particularly around the DevOps culture and more cutting-edge technology stacks (functional programming, micro service-driver/cloud-native architectures). Differently, I believe the scale of traditional FIs are going to put a significant lead time on adopting said practices and when buying from a wider range of stakeholders.”

Embracing agility

Despite this, DevOps isn’t the only practice financial institutions should be implementing. According to a recent report by Oracle, by embracing new operating models for modern finance we can become exactly the kind of “agile finance leaders” businesses require. This includes using cloud and digital technologies effectively, as well as requires finance professionals to develop a broad set of skills.

Graham Perry, Territory Manager at Neotys UK and Ireland, added: “Fintechs don’t carry the technical debt of traditional financial institutions so have an advantage from an agility point of view. Cloud architecture also enables fintechs to create scalable architectures, giving them a technical advantage and the ability to create an agile delivery culture.”

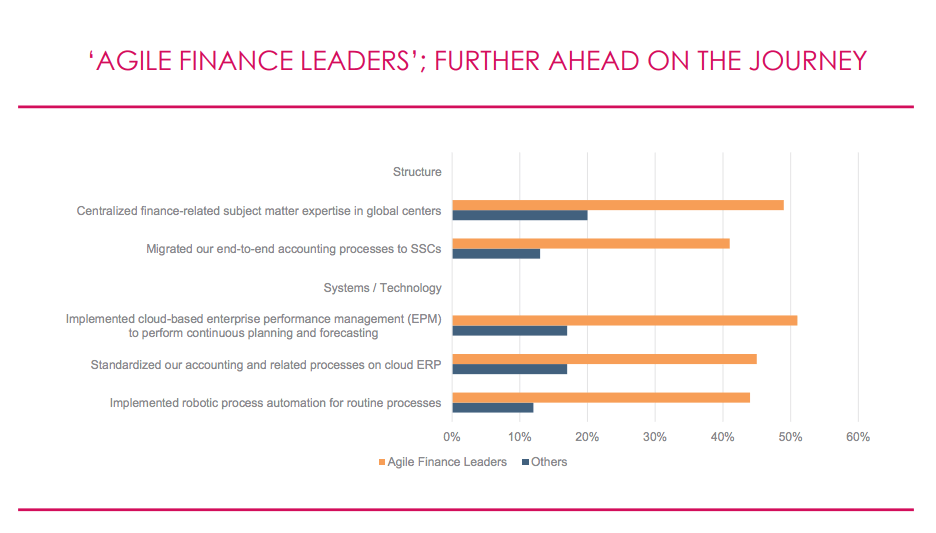

Interestingly, a graph by CIMA Global found that agile finance leaders are further ahead on the journey:

Furthermore, the EU legislation that regulates firms who provide services to clients linked to ‘financial instruments’ through electronic platforms, Markets in Financial Instruments Directive II (MiFID II), also appears to have a large impact on the way FIs operate.

EU legislation – MiFID 11

This fairly recent legislation makes sure that financial institutions operate in the “fairest and most transparent way possible”; ensuring regulators have a greater insight into regular goings on trading floors and sales desks across the region which, in theory, should help spot any irregularities early; giving banks greater responsibility to make sure that they are targeting appropriate investors for anything they sell.

“Flexible fintechs are able to reduce lead-times between code/deployment, and even the time between a change in market conditions and the deployment of the code it inspires. A good example would be how organisations in the industry react to regulatory change, such as MiFID 11, where, due to late final confirmation of terms, large established FIs are effectively forced to accept that there are lengthy delays when reflecting regulatory changes into systems. Whereas, with fintechs, the more rapid turnaround in converting an idea into deployable code the faster it’s able to react,” continued Grant.

MiFID 11 has been impacting fintech and its future since it came into force at the beginning of January. Typically, fintech consists of automation advice, high-frequency trading, blockchain and cryptocurrencies, digital payments, peer-to-peer lending, crowdfunding, artificial intelligence and big data analytics. AI and data analytics can be unregulated, while services such as blockchain, cryptocurrency, P2P, and crowdfunding usually follow national laws. This means fintech companies must follow the MiFID 11 guidelines when creating new innovative technologies in order to deliver services while protecting investors.

Conclusion

In conclusion, fintech doesn’t necessarily mean the end of traditional banks. The majority of large banks lack agility and DevOps practices, and instead, still rely on outmoded and unwieldy legacy IT systems. However, technology has revolutionised the way large banks work, so they should adjust to the potential of fintech by finding ways to collaborate with new entrants, while ensuring the MiFID II legislation is applied – at the end of the day, it’s all about entrepreneurial culture, collaboration and learning within the bank, as well as making a financial return.

Written by Leah Alger